flow through entity taxation

Limited liability companies LLCs that file federal income tax returns as partnerships Partnerships including limited partnerships limited liability. Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to claim a refundable tax credit equal to the tax previously paid on that income.

Pass Through Entity Definition Examples Advantages Disadvantages

The majority of businesses are pass-through entities.

. The entity itself is not taxed and any business losses incurred or income earned is treated as the owners personal incomeloss. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. 1 2021 contingent upon the existence of the TCJA SALT deduction limitation the legislation creates an elective tax on FTEs with business activity in Michigan.

Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap February 03 2022 by Bryan Bays. Effective for tax years beginning on or after January 1 2021 the Michigan flow-through entity tax enacted under 2021 PA 135 levies an elective income tax on flow-through entities with business activity in Michigan. That is the income of the entity is treated as the income of the investors or owners.

Flow-through entity tax For tax years beginning on and after Jan. Log on to Michigan Treasury Online MTO to update business details authorized representative information and to file or pay tax returns. Governor Whitmer signed HB.

Flow-Through Entity Tax - Ask A Question. 20 2021 Michigan Gov. The timely payment of the flow-through entity tax creates a refundable income tax credit and other adjustments that are passed through and.

As enacted this tax is retroactive to tax years beginning on or after January 1 2021 for flow-through entities that. The following types of common flow-through entities may elect to pay the flow-through entity tax in Michigan. 6 Members of the entity making the.

The FET is not available to disregarded entities single member LLCs. These parties then report the gains and losses on their own tax returns. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

Business entity which is transparent for tax purposes. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. The flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan state and city and allows members or owners of that entity to claim a refundable tax credit equal to the tax previously paid on that income.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. My recent article critically analysed the range of reasons that have historically been used to. Its gains and losses are allocated or flow through to those with ownership interests.

--Define substantial nexus for the purposes of the flow-through entity tax. Flow-through entities that make the election are subject to the flow-through entity tax which is levied at the same rate levied on individuals for the same tax year under Section 51 of the Income Tax Act ie 425 for tax year 2021. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital gain you reported created an exempt capital gains balance ECGB for that entity.

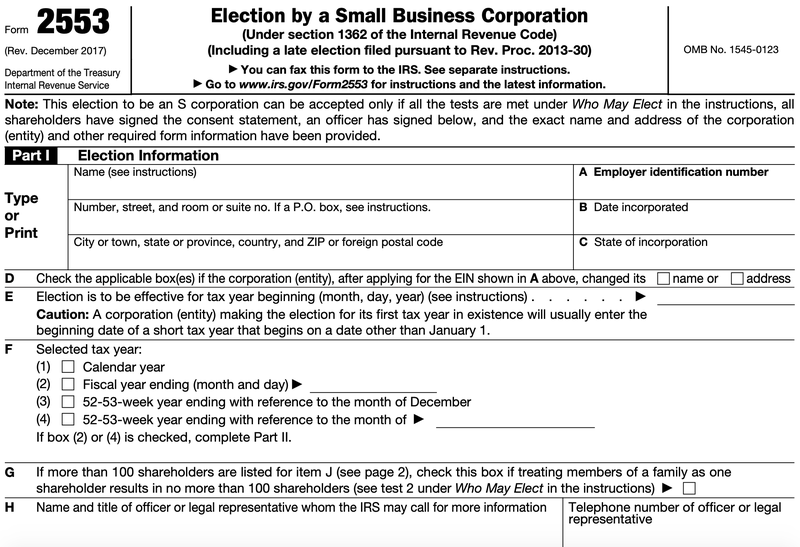

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. Retroactively effective for tax years beginning on or after January 1 2021 the law allows individual taxpayers with interests in partnerships or S corporations to reduce their federal. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels.

Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Whitmer signed House Bill 5376 into law which amended the Michigan Income Tax Act by implementing an elective flow-through entity tax. Flow-Through Entity Tax - Ask A Question.

Common Types of Pass-Through Entities. --Beginning January 1 2021 and each tax year after that levy and impose a flow-through entity tax equal to the individual income tax on every taxpayer with. Define various terms including flow-through entity and business income for the purposes of Part 4.

Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships. Flow-Through Taxation A flow-through entity is a legally designated entity type that allows business income to flow from the business to the business owners in the form of taxable income. For more information on the sale of this type of property see Disposing of your shares of or.

5 In general an FTE may elect to pay tax on certain income at the individual income tax rate. The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here. The resulting avoidance of.

This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. Virtually all states recognize traditional general partnerships and limited partnerships as flow through entities for taxation purposes.

Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence.

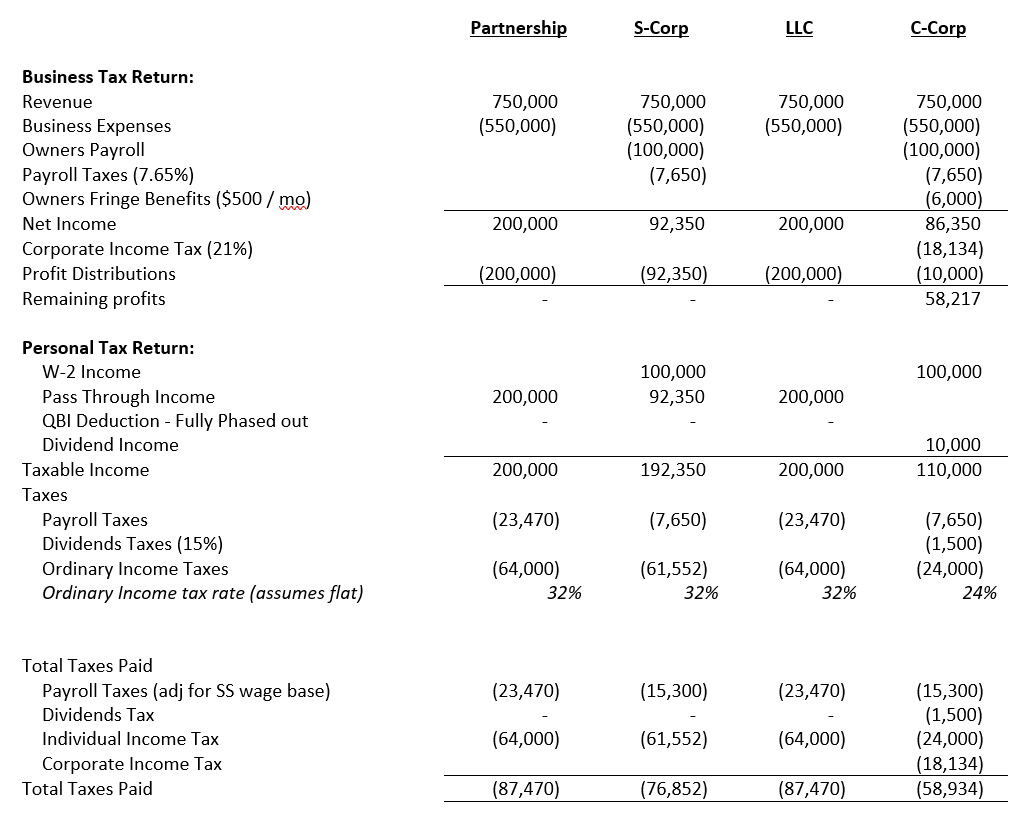

Business Entity Comparison Harbor Compliance

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

4 Types Of Business Structures And Their Tax Implications Netsuite

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

How To Choose Your Llc Tax Status Truic

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

How To Choose Your Llc Tax Status Truic

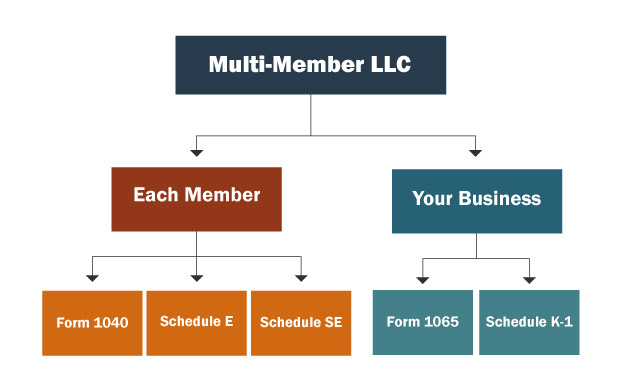

Multi Member Llc Taxes Llc Partnership Taxes

What Are The Tax Implications For An Llc Effects Of Operating As An Llc

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Pass Through Entity Tax 101 Baker Tilly

A Beginner S Guide To Pass Through Entities The Blueprint

What You Need To Know About Single Llc Taxes And Disregarded Entity

Hybrid Entities And Reverse Hybrid Entities International Tax Blog