dependent care fsa limit 2022

Generally health FSAs are not required to be reported on an employees W-2. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals.

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

The 125 cafeteria plan adopts a 2½.

. High-deductible health plans HDHP have grown in popularity. Tax year 2022. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022.

American Rescue Plan Act Of 2022 Dependent Care Fsa. Extend grace periods to 12 months for plan years ending in. View 2022 Health FSA Contribution Cap Rises to 2850 and IRS Clarifies Relief for FSA Carryovers.

For 2022 the exclusion for DC FSA benefits under Code Sec. It also increases the value of the dependent care tax credit for 2021. For 2022 the minimum deductible on an HDHP is 1400 for an individual and 2800 for a family.

That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000. Plan Options Now Available view our Table of Provisions NEW. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately.

July 1 2021 June 30 2022 IRS contribution limit. You can use your DCFSA dollars on a wide variety of child and adult care services. For 2022 and beyond the limit will revert to 5000.

Employers can choose whether to adopt the increase or not. Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. NEW LEGISLATIVE PROVISIONS for 2020-2022.

The exception to this rule is when an employees deductions for all benefits are less than the amount elected for the health FSA. What is the 2022 dependent care FSA limit. For 2022 the DC-FSA maximum which is set by statute and is not subject to inflation-related adjustments returns to 5000 a year for single taxpayers and married couples filing jointly or 2500 for married people filing separately.

The limit is expected to go back to 5000. The employee incurs 7000 in dependent care expenses during the period from January 1 2022 through June 30 2022 and is reimbursed 7000 by the DC FSA. Please note you may not double-dip expenses eg expenses reimbursed under your Dependent Care FSA may not be reimbursed under your.

A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. Therefore participants in dependent care. The maximum out-of-pocket expenses are 7050 for an individual and 14100 for a family.

The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for single taxpayers and married. The new limit for 2021 will be 10500 if single or married filing jointly 5250 if married filing separately. Dependent Care FSA Limits Dependent Care FSAs DC-FSAs also called Dependent Care Assistance.

You must incur qualifying expenses Qualifying Dependent Care Expenses The expenses incurred by dependent care flexible spending accounts as provided in accordance with IRS Code Section 129. Your Money Doesnt Roll Over. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately.

If you have a dependent care FSA pay special attention to the limit change. Employers can offer employees participating in health flexible spending accounts FSAs and dependent care FSAs greater flexibility for rolling over unused funds through 2022 under new IRS guidance. The Dependent Care FSA DCFSA can be offered alongside the standard medical FSA or as a stand-alone enhancement to help cover the eligible child or adult care expenses that are not covered or reimbursed by your other pre-tax accounts.

On December 27 2020 the Consolidated Appropriations Act 2021 was passed and includes new and extended benefits for Dependent Care FSA DCFSA plans. Im a teacher so my FSA plan year runs September 1-August 31. 125i IRS Revenue Procedure 2020-45.

Notice 2021-15 PDF issued in February 2021 states that if an employer adopted a carryover or extended period for incurring claims the annual limits for dependent care assistance program amounts apply to amounts contributed not to amounts reimbursed or available for reimbursement in a particular plan or calendar year. 5000 per household for the 2021-22 plan year. This last year my employer allowed us to set Dependent Care FSA contributions to 683333- that is 13 of the.

We get paid semimonthly. Back to main content If you and your spouse are both eligible to contribute to a Dependent Care FSA through your respective employers you and your spouse may not each claim 500000. IRS annual contribution limit for 2022.

This means that an employee can set aside 10500 in a dependent care fsa if their employer has one instead of the normal 5000. Your plan may cover 100 of your in-network preventive care before you reach your deductible. Dependent Care 2021-2022.

Dependent care expenses during the period from January 1 2022 through June 30 2022 and is reimbursed 7000 by the DCAP. April 13 2022 By.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What The New 2022 Hsa Limits Mean For You The Difference Card

What Is A Dependent Care Fsa Wex Inc

2022 Retirement Plan Contribution Limits

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

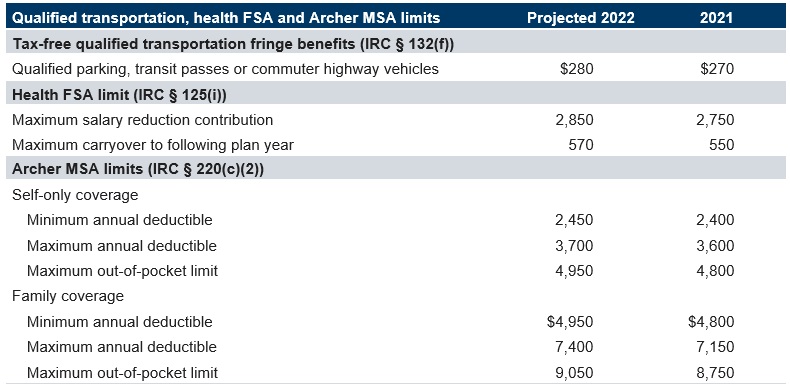

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Coh Dependent Care Reimbursement Plan

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services